does florida have capital gains tax on stocks

The rate you receive will depending on your total gains earned. Capital gains taxes are what you pay on those profits.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

The State of Florida does not.

. The schedule goes as follows. Take advantage of primary residence exclusion. Florida does not assess a state income.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Federal capital gains taxes. Florida does not assess a state income tax and as such does not assess a state capital gains tax.

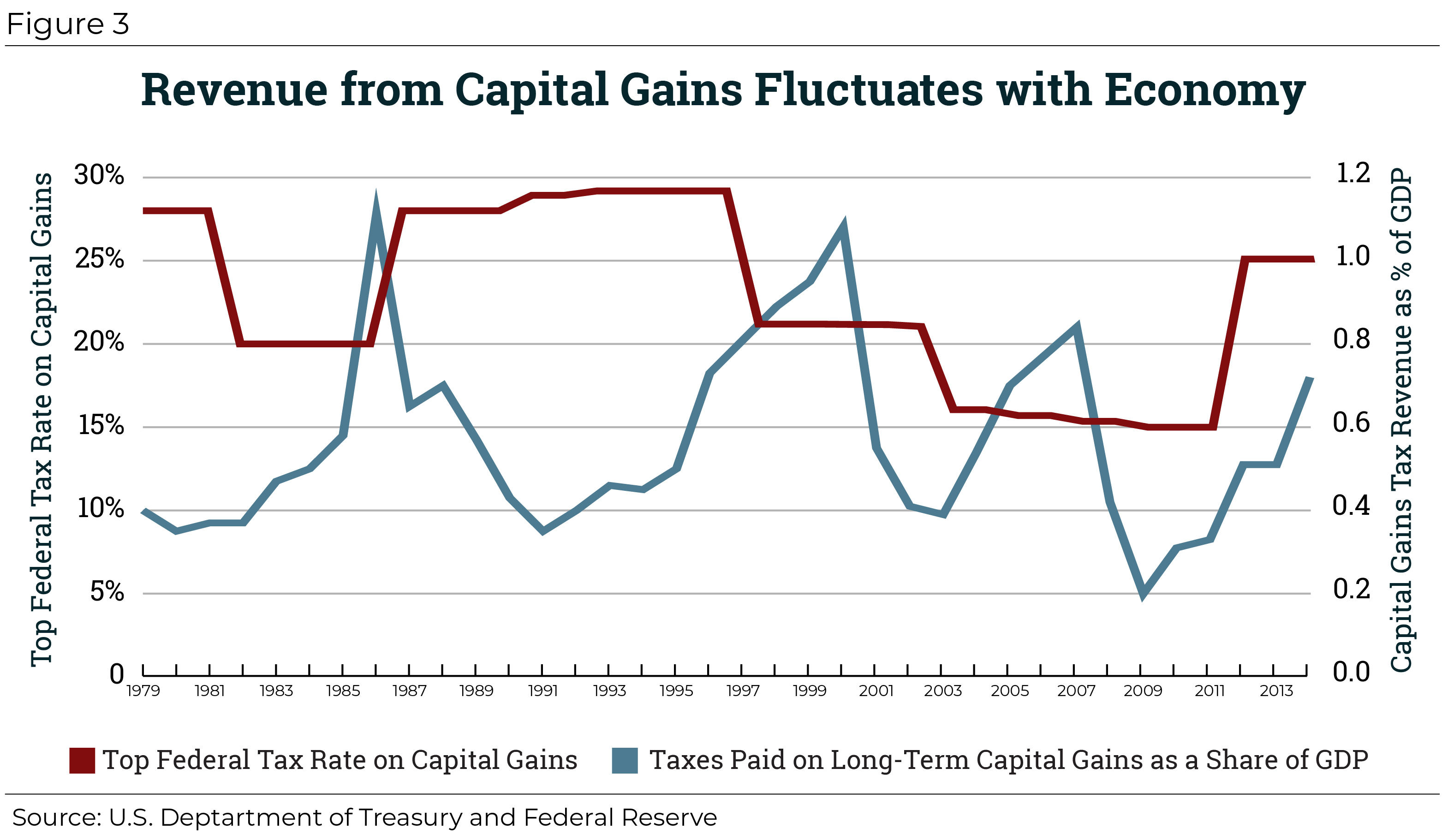

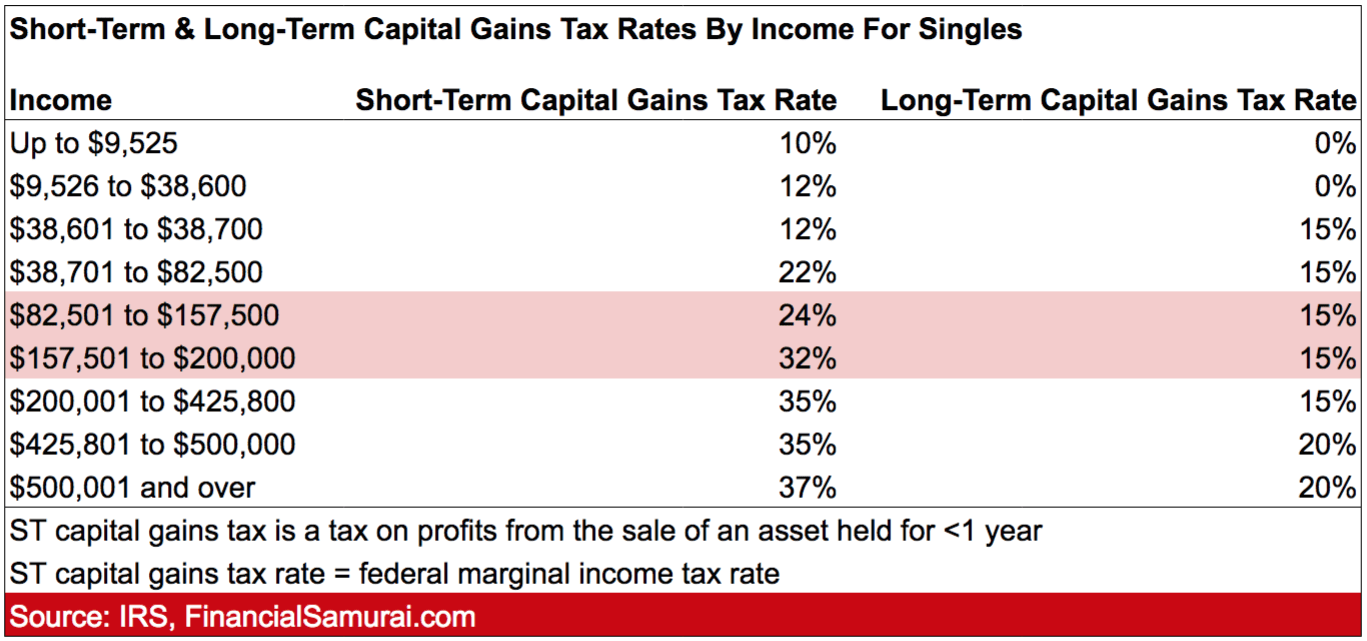

The goal of an investment whether you place your money in stocks a business or real estate is generally to end up with more money than you started with. The taxable portion of gain on the sale of qualified small business stock Section 1202 stock is also taxed at a maximum 28 rate. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year.

Tax Considerations When Selling Florida Real Estate W hen you sell a stock bond or mutual fund you owe taxes on your gain - the difference between what you paid and what you sold them for. Florida capital gains tax isnt levied on asset profits. Individuals pay capital gains taxes to the federal government.

Your primary residence can help you to reduce the capital gains tax that you will be subject to. 3 The portion of any unrecaptured Section. Does Florida have a capital gains tax.

Your long-term capital gains tax bracket is based on how much your long-term gains add on top of those. More specifically capital gains are treated as income under the tax code and taxed as such Here is what the states without a capital gains income tax told me. Long-term capital gains on the other hand are taxed at either 0 15 of 20.

When you earn enough money from investments youll have to start thinking about the tax implications of them. However theyll pay 15 percent on capital gains if their. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

You only pay them on realized gains upon sale. Capital gains are the profits you earn from the sale of capital assets such as stocks bonds and real estate. Calculate the capital gains tax on a sale of real estate property.

Any corporation that isnt treated as a pass-through. Individuals dont have to pay tax on investment income in Florida but for businesses the answer isnt as favorable. Capital gains are the profits realized from the sale of capital assets such as stocks bonds and property.

The amount that can be excluded. Capital gains tax rates on most assets held for less than a year correspond. AL AR DE HI IN IA KY MD MO MT NJ NM NY ND OR OH PA SC and WI either allow taxpayer to deduct.

For example if you file an individual tax return and had an adjusted. Florida Capital Gains Taxes. Any money earned from investments will be subject to the federal capital.

52 rows AK FL NV NH SD TN TX WA and WY have no state capital gains tax.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How High Are Capital Gains Taxes In Your State Tax Foundation

Short Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Tax In Kentucky What You Need To Know

The States With The Highest Capital Gains Tax Rates The Motley Fool

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Restricted Stock Units Jane Financial

Income Types Not Subject To Social Security Tax Earn More Efficiently

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Tax What Is It When Do You Pay It

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021